Life happens

Confidence Comes From Being Prepared

-John Wooden

What you need to know about long-term care insurance

Who will care for you when you can’t care for yourself?

Chances are the day will come when you won’t be able to manage on your own. In fact, almost 70 percent of those over age 65 will require some form of long-term care during their lives.

Long-term care includes all the assistance you would need with daily living tasks if a chronic illness or disability leaves you unable to care for yourself for an extended period of time. It could be care in your own home or in a specialized facility.

Care Options that may be available to you

Many people think their private health insurance or Medicare would pay,

but that’s typically not true. Health insurance really only pays for doctor and hospital bills. Medicare will cover skilled care for periods up to 100 days, but only if certain requirements are met. If you need care over an extended period of time, you’d have to spend down your assets before Medicaid would kick in, and then,

you’d have less choice about the care you receive. Others assume their loved ones would provide the care they may someday need, but that’s an imperfect plan. Many don’t recognize the significant negative impact caregiving could have on the caregiver, who often suffers emotionally and financially as a direct result of their caregiving responsibilities.2 If your plan is to turn to your family, is that what’s really best for you and them?

Long-term care includes all the assistance you would need with daily living tasks if a chronic illness or disability leaves you unable to care for yourself for an extended period of time. It could be care in your own home or in a specialized facility.

Care Options that may be available to you

Many people think their private health insurance or Medicare would pay,

but that’s typically not true. Health insurance really only pays for doctor and hospital bills. Medicare will cover skilled care for periods up to 100 days, but only if certain requirements are met. If you need care over an extended period of time, you’d have to spend down your assets before Medicaid would kick in, and then,

you’d have less choice about the care you receive.

Koonsman Family: Facing the Unexpected

Jamey and Robyn Koonsman met in college and realized they shared a love of the land and the animals that populated the ranches they grew up around. Once married, they shared their passion with their daughters, Hope and Jordyn. The family spent their free time attending stock shows and rodeos. Hope loved nothing more than showing steers and truly owned the ring when she was in it, and Jordyn took a shine to rodeo riding.

While it’s nothing a family should ever have to suffer, Hope died unexpectedly when she was just 19, the result of a birth defect the family thought was long in the past. It proved fortunate that the couple had done life insurance planning early on with their insurance professional Paul Miller. Not only had they bought a combination of permanent and term life insurance for themselves, they had purchased permanent life insurance for both girls. Their plan was to gift the policies to the girls once grown. Instead, they used Hope’s policy to pay medical bills and to start a foundation in her honor.

Layered on this tragedy was Robyn’s ongoing fight with breast cancer. She had been battling the disease over the course of eight years. Then, less than two years after Hope died, Robyn lost that battle at age 37. In the wake of her death, life insurance did what it was meant to: pay for medical bills and final expenses, and allow Jamey and Jordyn to continue living in their home without financial concerns. Jordyn has also been able to pursue her rodeo riding, which has sustained her through these tragedies.

Jamey says that when they originally got life insurance in their 20s, they never expected to use it.

Jamey says that when they originally got life insurance in their 20s, they never expected to use it. So his message to others is simple: “You’re never too young to get life insurance, because you never know what will happen. Make sure you take care of your family, so if something does happen, they won’t struggle.”

Long-term care insurance puts you in control

Long-term care insurance helps make sure

that you’ll have access to high- quality care should you ever need it. Using

insurance to pay for care also

means that you won’t need to choose between getting

the assistance you need and spending down your life’s savings.

In short, long-term care insurance puts you in control. But are you the right age to consider it? Can you afford it? And if so, what kind of benefit features should your policy include? This guide will answer these questions and help determine if long- term care insurance is right for you.

In short, long-term care insurance puts you in control. But are you the right age to consider it? Can you afford it? And if so, what kind of benefit features should your policy include? This guide will answer these questions and help determine if long- term care insurance is right for you.

Where care is provided

Professional care can be delivered in a variety of different settings, and many long-term care insurance policies give you the option to receive care in the setting of your choosing.

Home health care: Services provided at home

Assisted living facility: Residential care setting that provides housing and support services for people wanting or needing assistance with daily living tasks

Memory loss units: Often located as a separate wing of an assisted living facility, these units provide 24-hour support and locked premises to assure that no one wanders off

Nursing home: Full-time care in a dedicated facility

Adult day care: Community-based, daytime supervision providing social, recreational or health assistance off-site during working hours

Home health care: Services provided at home

Assisted living facility: Residential care setting that provides housing and support services for people wanting or needing assistance with daily living tasks

Memory loss units: Often located as a separate wing of an assisted living facility, these units provide 24-hour support and locked premises to assure that no one wanders off

Nursing home: Full-time care in a dedicated facility

Adult day care: Community-based, daytime supervision providing social, recreational or health assistance off-site during working hours

When will a policy start to pay for care

Generally, long-term care insurance policies begin to pay benefits when one of two different

criteria is met and you have

met the elimination period.

You are unable to perform two of the six activities of daily living (ADLs) without assistance or supervision:

Continence: Control of one’s bladder and bowel movements

Dressing: Clothe oneself

Toileting: Use a toilet and perform associated personal hygiene or

Eating: Feed oneself

Bathing: Bathe oneself

Transference: Move oneself into or out of a bed or a chair

You are unable to perform two of the six activities of daily living (ADLs) without assistance or supervision:

Continence: Control of one’s bladder and bowel movements

Dressing: Clothe oneself

Toileting: Use a toilet and perform associated personal hygiene or

Eating: Feed oneself

Bathing: Bathe oneself

Transference: Move oneself into or out of a bed or a chair

OR

You have severe cognitive

impairment, such as Alzheimer’s disease and other forms

of dementia, which make it impossible for you to live independently in a

safe manner.

Understanding Key Features and Benefits

When considering a long-term care insurance policy, you should be familiar with the following:

Daily/monthly benefit: The maximum daily or monthly amount your policy will provide toward the cost of long-term care.

Benefit cap: The maximum benefit amount available under a policy (e.g., $360,000).

Elimination period: The waiting period before benefits are paid (e.g., 90 days). Opting for a longer waiting period is a good way to lower your premium cost.

Inflation rider: A provision that helps benefits keep pace with the increasing cost of care. See box below.

Shared benefits rider: A provision that allows a couple to share benefits between their policies. For example, if they each have $250,000 of benefits but one partner exhausts his or her entire benefit, that partner can begin drawing on benefits from the other partner’s policy.

Free-look period: A 30-day time frame after purchasing insurance, during which you may cancel for a full refund of your premium.

Guaranteed renewability: Your policy cannot be canceled, and premiums cannot be increased unless all policies ofthat type within a particular state are increased together.

Non-forfeiture provision: If an insurer increases premiums beyond a specific percentage, a policyholder has the option to retain coverage at a reduced level of benefits.

Exclusions: Certain conditions are listed as exclusions for most policies including, but not limited as policies vary, to alcoholism, drug abuse, some mental illnesses and nervous disorders. Self-inflicted injury is also usually excluded from coverage.

Daily/monthly benefit: The maximum daily or monthly amount your policy will provide toward the cost of long-term care.

Benefit cap: The maximum benefit amount available under a policy (e.g., $360,000).

Elimination period: The waiting period before benefits are paid (e.g., 90 days). Opting for a longer waiting period is a good way to lower your premium cost.

Inflation rider: A provision that helps benefits keep pace with the increasing cost of care. See box below.

Shared benefits rider: A provision that allows a couple to share benefits between their policies. For example, if they each have $250,000 of benefits but one partner exhausts his or her entire benefit, that partner can begin drawing on benefits from the other partner’s policy.

Free-look period: A 30-day time frame after purchasing insurance, during which you may cancel for a full refund of your premium.

Guaranteed renewability: Your policy cannot be canceled, and premiums cannot be increased unless all policies of

Non-forfeiture provision: If an insurer increases premiums beyond a specific percentage, a policyholder has the option to retain coverage at a reduced level of benefits.

Exclusions: Certain conditions are listed as exclusions for most policies including, but not limited as policies vary, to alcoholism, drug abuse, some mental illnesses and nervous disorders. Self-inflicted injury is also usually excluded from coverage.

How much coverage do you need?

The kinds and amount of benefits you need will depend on your budget, your geographic region, and what kind of care you think you’d want. It also may depend on whether you have any loved ones who want to play some role in your care. Here are some important questions to ask yourself to determine the amount of coverage that’s right for you.

Do I want my policy to cover the entire cost of care, or can I afford to supplement the expenses from my retirement income and assets?

• Do long-term illnesses, such as dementia, run in my family?

• Has anyone in my family ever needed long-term care?

• What assets do I want to preserve and pass along to my spouse, partner or heirs?

• How much of my care, if any, will be provided for by family members?

Do I want my policy to cover the entire cost of care, or can I afford to supplement the expenses from my retirement income and assets?

• Do long-term illnesses, such as dementia, run in my family?

• Has anyone in my family ever needed long-term care?

• What assets do I want to preserve and pass along to my spouse, partner or heirs?

• How much of my care, if any, will be provided for by family members?

Tips to help save on premiums

Buy young:

Rates, in part, are based on your age. The younger you are, the lower your premiums generally will be. Also, the older you get, the more likely you are to have

health concerns that make you uninsurable or would make coverage more costly. Almost half of the people age 70 or older who apply will not be eligible because of their health.

Preferred health discounts: Most insurers offer preferred discounts to those in exceptional health. The majority of policies are issued with standard rates. If you qualify as a preferred customer, discounts of 10 percent or more may be available.

Couples/partner discounts: Many insurers offer discounts when both spouses or domestic partners apply for coverage together. Some may even offer discounts to

multi-generational families or siblings who reside together.

Starter policies: Other financial priorities may make a comprehensive policy seem out of your reach, but some insurance plans can be designed to offer a smaller starter policy to give some protection now. You can sometimes add additional coverage down the road, or buy a supplemental plan to complement your initial policy.

American Association for Long-Term Care Insurance, 2010 LTCi Sourcebook

health concerns that make you uninsurable or would make coverage more costly. Almost half of the people age 70 or older who apply will not be eligible because of their health.

Preferred health discounts: Most insurers offer preferred discounts to those in exceptional health. The majority of policies are issued with standard rates. If you qualify as a preferred customer, discounts of 10 percent or more may be available.

Couples/partner discounts: Many insurers offer discounts when both spouses or domestic partners apply for coverage together. Some may even offer discounts to

multi-generational families or siblings who reside together.

Starter policies: Other financial priorities may make a comprehensive policy seem out of your reach, but some insurance plans can be designed to offer a smaller starter policy to give some protection now. You can sometimes add additional coverage down the road, or buy a supplemental plan to complement your initial policy.

When Should You Buy?

It’s true that most long-term care insurance claims are made when people reach their golden years, but there’s a misconception that you should wait until you’re approaching retirement to buy a policy. Waiting too long to purchase a policy can be very costly. Because rates are based on age and health, it’s best to start shopping for a policy when you’re young and healthy.

Rates are based on age and health. The younger you are, the lower your premiums generally will be.

A good time to purchase is when you’re in your 40s or 50s. You can certainly buy a policy when you’re in your 60s or even older, but expect to pay considerably more. Plus, if you wait too long and develop a condition that may require long-term care, you could become uninsurable.

Ways to Get Coverage

Through an insurance professional.

Working with a professional who specializes in

long-term care insurance provides you with a lot of flexibility and personal guidance. An insurance professional can help you shop around for the best policy among multiple insurance companies, and customize a plan to include the combination of features and benefits that works best for your needs and budget. If you’re in good health, you may qualify for preferred pricing. That’s because the policy will be individually underwritten, meaning the insurance company will base its price on your health history. Pros:Flexibility, personal guidance. Custom solution. Good health discount may be available.

long-term care insurance provides you with a lot of flexibility and personal guidance. An insurance professional can help you shop around for the best policy among multiple insurance companies, and customize a plan to include the combination of features and benefits that works best for your needs and budget. If you’re in good health, you may qualify for preferred pricing. That’s because the policy will be individually underwritten, meaning the insurance company will base its price on your health history. Pros:

Through your employer.

This is a convenient option because you often can pay your premiums through payroll deduction. Buying through work can save you the time of researching many policies because your employer will have done that work for you. If you’re not in perfect health, buying a policy through work may make a lot of sense since you may be asked fewer health-related questions in order to qualify for coverage. However, if you’re healthy, you’ll often pay the same price as everyone else in your general age range, which means you might not get rewarded for your good health, as you might with an individual policy. Also keep in mind that with employer-sponsored coverage, your choice of policy features may be limited because some offer only certain options. Pros: Pre-selected plans from which to choose. Payroll deduction. Easier to enroll and qualify.

Through associations or membership groups.

Policies may be offered through alumni groups, trade groups and other organizations to which you belong. Premiums are often discounted and are based primarily on your age and health. The plans they offer could look a lot like individual plans offered through a professional, or similar to plans offered though employers. Either way, you will generally work with

a specialist to help you understand your options and enroll. Pros: Discounted pricing.

a specialist to help you understand your options and enroll. Pros: Discounted pricing.

Take Advantage of Government Incentives

To encourage more Americans to take responsibility for their future care needs, the government has developed a variety of incentives to reward those who buy long-term care insurance. Here are some you should know about.

Partnership programs: Long-term care insurance partnership programs are designed to encourage consumers to buy private long-term care insurance, which will help you avoid spending down most of your assets to qualify for Medicaid-sponsored long-term care. Over the long haul, these partnerships between states and private insurance companies save money for both consumers and the government. Programs vary by state, so talk to your insurance professional about how this could apply to you.

Federal tax incentives: If you buy a federally qualified policy (and most policies are), your insurance premiums may be deductible as part of your medical expenses on federal tax returns and benefits are received tax-free.

State tax incentives: A majority of states have a state tax incentive for residents who purchase long-term care insurance.

Incentives for business owners: There are also tax advantages for businesses that buy long-term care insurance. Premiums for tax-qualified policies paid for employees, their dependents, spouses, and retirees may be tax deductible as a business expense.

Make sure to consult with your tax advisor to fully understand which tax benefits may apply to your particular situation.

Partnership programs: Long-term care insurance partnership programs are designed to encourage consumers to buy private long-term care insurance, which will help you avoid spending down most of your assets to qualify for Medicaid-sponsored long-term care. Over the long haul, these partnerships between states and private insurance companies save money for both consumers and the government. Programs vary by state, so talk to your insurance professional about how this could apply to you.

Federal tax incentives: If you buy a federally qualified policy (and most policies are), your insurance premiums may be deductible as part of your medical expenses on federal tax returns and benefits are received tax-free.

State tax incentives: A majority of states have a state tax incentive for residents who purchase long-term care insurance.

Incentives for business owners: There are also tax advantages for businesses that buy long-term care insurance. Premiums for tax-qualified policies paid for employees, their dependents, spouses, and retirees may be tax deductible as a business expense.

Make sure to consult with your tax advisor to fully understand which tax benefits may apply to your particular situation.

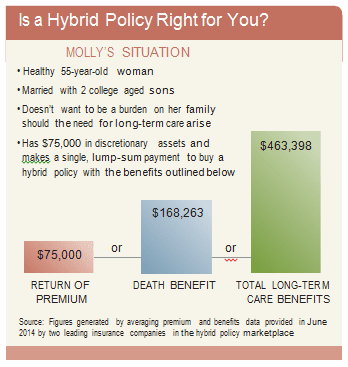

Hybrid Policies

Long-Term Care Insurance Linked With Life Insurance or an Annuity

For people who are concerned about their future long-term care needs but not convinced that traditional policies are the solution for them, there’s a newer kind of insurance option that is growing in popularity. They’re alternatively called hybrid, combo or linked- benefit products and they typically incorporate long-term care benefits with a life insurance policy or an annuity.

Life insurance may be a very high priority for your family right now. But over time, your need for life insurance will likely diminish and the need to pay for long-term care may become a higher priority. These policies allow you to serve both needs with one policy.

In short, you’d buy a life insurance policy or an annuity, but the policy would include long-term care coverage as a secondary benefit. If a need arises, you can access the policy’s long-term care benefits to pay for long-term care services. If you never need long-term care, there is a death benefit for your heirs and/or an annuity from which you could take regular payments.

These policies can be structured as a lump sum or an annual stream of premiums. Speak to an insurance professional about the possibilities offered by these newer policies.

Life insurance may be a very high priority for your family right now. But over time, your need for life insurance will likely diminish and the need to pay for long-term care may become a higher priority. These policies allow you to serve both needs with one policy.

In short, you’d buy a life insurance policy or an annuity, but the policy would include long-term care coverage as a secondary benefit. If a need arises, you can access the policy’s long-term care benefits to pay for long-term care services. If you never need long-term care, there is a death benefit for your heirs and/or an annuity from which you could take regular payments.

Contact Information

Phone:

407-351-4153

Mobile: 407-608-9924

Email: quotes@gsepropertyandcasualty.com

Email: Donnice@gsepropertyandcasualty.com

Email: JohnHerrick@gsepropertyandcasualty.com

Mobile: 407-608-9924

Email: quotes@gsepropertyandcasualty.com

Email: Donnice@gsepropertyandcasualty.com

Email: JohnHerrick@gsepropertyandcasualty.com

Hours of Operation

| Mon-Fri | 09:00 AM - 05:00 PM |

| Sat-Sun | Closed |

Our Location

Browse Our Website

Contact Information

Phone: 407-351-4153

Mobile: 407-608-9924

Email:

quotes@gsepropertyandcasualty.com

Hours of Operation

| Mon-Fri | 09:00 AM - 05:00 PM |

| Sat-Sun | Closed |

Our Location

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited.

Terms of Use |

Privacy Policy